ZimCal Asset Management LLC

BIMIZCI Fund LLC & Warnke Investments LLC

4737 County Road 101, #264

Minnetonka MN 55345

www.restoretheshine.com

April 26, 2024

Dear Fellow Stockholders of Medallion Financial Corporation,

This year you have the power to effect change at Medallion Financial Corp. (also the “Company” or “MFIN”). We are asking you to vote for two new Directors of the Company nominated by Stephen Hodges, ZimCal Asset Management and its affiliates (together “ZimCal”) to the Board of Directors of the Company (the “Board”) using the enclosed WHITE proxy card or WHITE voting instruction form. ZimCal has been an investor in the Company for over 3 years. We currently own 70,010 shares of common stock and $15 million in debt, making us one of the single largest investors in the Company. Excluding Medallion Financial Corp. insiders, our stock ownership makes us a top 20 voting stockholder according to the latest 13F filings by institutional stockholders. Our interests are squarely aligned with ALL MFIN’s stockholders – simply put, we want Medallion Financial Corp. to thrive in the long term. We have nominated two highly qualified individuals, Stephen Hodges and Judd Deppisch, who have been leaders in their respective organizations in current and prior roles. They have the skills and commitment to create long term value for stockholders and employees. They will hold management accountable and put stockholders first. Our nominees have a combined 40 years of financial experience in areas that directly overlap with the Company’s core business, including consumer lending, risk management, banking and credit analysis. They are approximately 30 years younger than the average age of the current Board (75 years) and 35 years younger than the average age of the Directors they are running against (80 years). We do not believe that being “younger” or “older” means Directors are effective or not, but we do believe that every Board needs fresh perspectives and independent thinkers, and we are looking to replace two individuals with long ties to MFIN, including the father-in-law of Andrew Murstein (the COO and President of MFIN) who has been on the Board for 28 years. Please visit and sign-up at www.restoretheshine.com for updates and more details.

1. Why are we looking to change the Board and asking for your support?

We are concerned about the future of Medallion Financial Corp. for 4 main reasons:

1. We are concerned about the downward stock price over time, particularly the 40% decline over the last 10 years and the year-to-date decline of 20% through 03/28/24 (see Figure 1A and 1B below) which seems to reflect a lack of investor interest in and concerns about the Company;

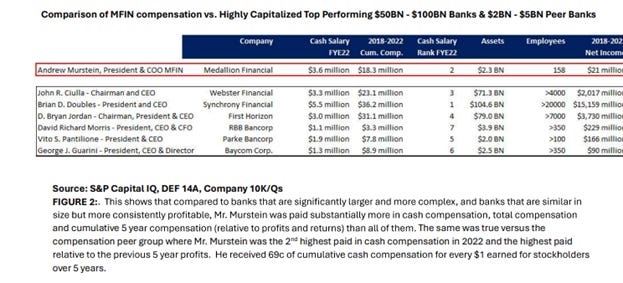

2. We believe that it is time for the Board to stop putting the interests of the Mursteins and senior management before those of stockholders. The entire Board, and the two directors we are looking to replace, should be held accountable for approving a management compensation plan that we believe is excessive, rewards short-term thinking and is tied to non-core, non-recurring performance. We also believe that the rank-and-file “lower-level” employees who work hard every day to improve MFIN, deserve to be better compensated for their efforts. Andrew Murstein was paid $9.5 million combined in 2021 and 2022. A huge sum for most of us and the average MFIN employee. Mr. Murstein was paid more in cash pay than the CEOs/Presidents of top performing, highly capitalized FDIC-insured banksi more than 30x the size of the Company with several thousand employees. And these are banks that have consistently performed and generated billions in stockholder profits over the last 5 yearsii compared to the $21 million Mr. Murstein has generated from 2018-2022 (see Figure 2 below);

3. We believe the Board needs to hold management accountable for the decline in MFIN’s core business profitability and credit quality over the last 2 years, which has been disguised by non-core, non-recurring Taxi Medallion recoveries as explained below (See Figures 3 and 4 below). MFIN’s core performance, which removes the impact from non-recurring earnings, has deteriorated and is trending down as we enter what we expect to be a more difficult economic and lending environment. To add to that, at 4Q23 MFIN had $508 million in subprime Recreation loans (MFIN’s largest loan category), and Recreation chargeoffs hit 4.3% at 4Q23, exceeding their pre-pandemic highiii.

4. We are concerned about the SEC lawsuit. We feel that the Board needs to deal with and resolve the SEC lawsuit quickly. The SEC lawsuit is a huge obstacle to investors trusting and believing in MFIN. Resolving it would give stockholders the ability to quantify the financial impact of the lawsuit on their investment and would take away a big distraction.

Enclosed are our proxy materials, including a WHITE proxy card or WHITE voting instruction form where you may vote FOR our two nominees to the Board. If your shares are held with a bank or broker, you may vote your shares over the Internet too. We want to earn the support of all investors, whether you have 10 shares or 500,000 shares, I promise that we will always work for you.

Concerned about the trends we were seeing after 2Q23, we submitted our 28-page analysis and concerns to the Board in October 2023 and received an invitation to talk. Through subsequent discussions with management, it became clear that they were often unprepared with responses to our analysis, despite being provided with questions ahead of our meetings. This suggested to us that they did not share the same level of concerns we did about the business, or worse, did not see the potential risks we saw. Risks that would impact all stockholders and creditors alike. As we told the Company in December 2023, since we failed to persuade the Board or management to change in response to the risks we identified, the only way forward was to buy common stock and seek the support of other stockholders, large and small, to vote for new Directors. We repeatedly asked management if we could work collaboratively and privately to find a solutioniv but were rejected. Eventually, 6 months after first approaching the Company, we went public with our campaign for change on April 12, 2024. That is why we have nominated two individuals to the Board at this year’s upcoming Annual Meeting: so we can make sure the Company thrives in the long run. Please visit www.restoretheshine.com to understand why we think changes need to be made now.

2. We are not worried about the next quarter. We are worried about the next 4 quarters and the next 4 years.

We believe that MFIN cannot thrive in the long-term without making a radical change to its Board, its management team, and its business focus in a rapidly changing world. We believe we are now at a critical point where there is a high chance of near-term and long-term pain for the Company and its stockholders. A confluence of economic events, including higher for longer interest rates pressuring borrowers, rapidly worsening consumer delinquencies/charge-offsv (higher than the pre-pandemic highs), cyclicality in Recreation and Home Improvement demand (MFIN’s 2 main lines of business), and more expensive funding are just a few of the nearterm material risks that could result in lowered profits or losses for MFIN. On top of this, MFIN also had 20% of its assets in subprime Recreation loans at 4Q23. To address those serious risks, we believe that MFIN must change now and prepare now, and that begins with voting in our two new Directors. We do not want a repeat of what happened during the Taxi Medallion implosion years ago when the Company ignored its critics, and did not proactively deal with the risks in the Taxi Medallion portfoliovi and as a result, the Company lost almost 85% of its market value from the beginning of 2014 to the low in 2017. It was not short sellers that caused the $270 million in Taxi Medallion loan write-offs (through 4Q23),vii it was caused by bad loans to distressed borrowers and the Company not proactively managing its risk.

We believe, and we hope you do too, that the status quo is unacceptable. Excuses and scapegoating are not going to help generate stockholder value. The Company’s recent preliminary proxy filing contained untruths that were aimed at Mr. Hodges personally, seemingly in an attempt to undermine ZimCal’s message, expertise and intentions, which we believe insults the intelligence of our fellow stockholders. For example, they suggest that ZimCal’s interests conflict with those of other stockholders, which is not true. Like all stockholders, we desire a well run, more valuable Company that will thrive in the long-term. ZimCal has been an investor for 3 years, is one of the Company’s largest investors, and for 6 months ZimCal sought a private collaborative approach with the Company to help improve the way the Company was run. Only after these efforts were rejected did we go public with a proxy contest and seek to change the Board. We saw this reaction (the personal attacks and untruths) when the Company was criticized 7 to 10 years ago, and the outcome then was disastrous. We would prefer the Company focus on the data-supported issues and risks we identified to them 6 months ago, rather than conduct a mud-slinging campaign which we believe is inappropriate and unproductive.

3. Even though the stock price is down, we believe in the tremendous potential of the Company’s core business

The Company’s stock price was down 40% over the last 10 years (03/28/14-03/28/24), was down 20% year-todate (through 03/28/24), and we believe it could fall much further absent a radical course correction. Since the Company’s main and only profitable subsidiary (94% of revenues at FYE23) is a regulated, FDIC-insured with regulators setting strict rules on capital requirements and who can approve/disapprove of new business lines, we feel that MFIN stock should be judged and compared to other FDIC-regulated lenders. MFIN’s peer banks viii those with assets between $1BN to $5BN were up 61% over the last 10 years. MFIN likes to use 3-year and 5- year returns to show gains in its stock price. We believe that MFIN has cherry picked return periods without providing valuable context. The 5-year price change is shortly after MFIN had its largest loss in 2018 and off a 10 year low in 2017 (excluding the COVID 2020 plunge) (see Figures 1A and 1B). The 3-year return began 4 months after the price plunge from when the SEC investigation was announced in December 2021. Regardless, the 48% plunge in MFIN’s stock price in the first 5 years (03/28/14 – 03/28/19), means that the stock still has not made it to break-even after 10 years. However, we believe that the Company could have a bright future with the right governance, leadership and strategic plan. Our 5 Step plan outlined below, and in much more detail on our website, provides a clear and simple path forward. www.restoretheshine.com/5-steps

4. We believe that the Board is more interested in making the management team richer rather than looking out for stockholders.

We believe that it is time for the Board to stop putting the interests of the Mursteins and senior management before those of stockholders. The entire Board, and the two directors we are looking to replace, should be held accountable for approving a management compensation plan that we believe is excessive, rewards short-term thinking and is tied to non-core, non-recurring performanceix. It appears that the Company is being run like a family business with 3 current Board members in the Murstein family, and there has been no accountability for Andrew Murstein. This is not just obvious to us, it is also obvious to institutional investors who typically prefer strong, independent governance in companies they invest in. Ironically, both Andrew Murstein and his father Alvin Murstein currently own 10% and 7.8% of outstanding shares, which would suggest aligned interests with the broader stockholder group but we believe that their substantial cumulative CASH compensation ($24.9 million and $13 million from 2014-2022) and high cash/non-cash compensation ratio (average 85% cash/noncash)x combined with weak MFIN stock performance (Andrew Murstein’s ownership stake in MFIN at 04/24/23 was worth $5.9 million less than it was at 04/17/14)xi means they have been able to comfortably rely on salaries and bonuses, and have been less focused on creating long-term stockholder value. Since the Company’s main and only profitable subsidiary (94% of revenues at FYE23) is a Utah DFI/FDIC-insured bank (as mentioned above), we feel that MFIN should be judged and compared to other FDIC-regulated lenders rather than the mostly specialty finance companies it is compared to currently by the Boardxii. We have compared MFIN to both and in all cases, executive compensation is massively excessivexiii. Mr. Mursein was paid more in cash pay than top performing, highly capitalized FDIC-insured banks more than 30x the size of the Company with several thousand employees and hundreds of branches (see Figure 2 below). And these are banks with large and consistent xiv profits that have generated billions in stockholder profits over the last 5 years compared to the $21 million at MFIN.xv Synchrony Financial is a large, $105 billion asset consumer-focused lender and was included for comparison purposes because it is FDIC-insured, an industrial bank and consumer-focused. Mr. Murstein was paid more in cash compensation than every comparison bank except Synchrony Financial’s CEO, who was paid $5.5 million in cash comp in 2022 and $36 million in cumulative total compensation (cash and stock) from 2018-2022 after generating $15 billion in cumulative profits from 2018-2022. Mr. Murstein was paid $3.6 million in cash comp in 2022 and $18.3 million in cumulative total compensation from 2018-2022 after generating only $21 million in cumulative profits from 2018-2022 (see Figure 2 below).xvi Mr. Murstein received half Synchrony’s President’s total compensation over the 5 year period but generated only 0.14% of the cumulative profits for stockholders. Please note that all data is through FYE22 because that is the most recent compensation data that has been provided by ALL comparison companies. Once all companies have disclosed their compensation data for FYE23, we will update our numbers. We do know that Mr. Murstein’s total compensation was $6.5 MILLION in FYE23. A 36% increase over FYE22. Please visit and sign-up at www.restoretheshine.com for updates and more details.

5. We believe that recent profits do not reflect the Company’s underlying core business health

Despite what appear to be “record” profits in the last 3 years, we believe that profits were artificially boosted by a combination of anomalous, ultra-low consumer loan charge-offs and non-recurring net recoveries related to the Company’s non-core Taxi Medallion assets. Charge-offs (net) (excluding the Taxi Medallion impact) were only $3.1 million in 2021 but increased to $49.5 million in 2023. The impact of the Taxi Medallion recoveries boosted net income $30 million or 43% in 2022-2023. Xviii xvii We expect earnings to fall dramatically in 2024 with higher consumer loan charge-offs and lower Taxi Medallion recoveries, since Taxi Medallions were only 0.5% of gross assets at FYE23. While these Taxi Medallion recoveries are commendable, we note that cumulative Taxi Medallion charge-offs totaled $270 MILLION from 2015 through 2023 which was almost catastrophic and could have been avoided or reduced if management had listened to their critics (despite their critics’ obnoxious tactics) instead of simply attacking and dismissing them. The fact that the Company’s stock price has declined year-todate and the Company was valued at just over 1.0x tangible book at 1Q24, shows that the market appears to be discounting the recent “record” profits and may not see them as sustainable, much like we do. To make matters worse, executive bonuses were materially increasedxix by the Taxi Medallion non-core recoveries rather than decreased due to the declining Company’s core business performance.xx At 4Q23, the Company’s core business (excluding Taxi Medallions) had deteriorating ROA and ROE (0.9% and 6.8% respectively see Figure 3), subprime loans were 20% of total assets, quarterly consumer charge-offs worsened to 3.2% (worse than the previous cyclical high at 4Q19 see Figure 4), and funding costs were up 200% in 2 years.

6. We remain concerned about the SEC complaint

Mr. Murstein, along with MFIN was originally charged by the SEC with:

“violating the antifraud, books and records, internal controls, and anti-touting provisions of the federal securities laws. Murstein is also charged with making false statements to Medallion [Financial Corp.]’s auditor… The SEC seeks permanent injunctions, disgorgement plus prejudgment interest, and civil penalties. In addition, the SEC seeks an officer-and-director bar against Murstein.”

These charges, despite implications in the Company’s disclosures, xxiii xxii are current and serious for both Mr. Murstein and the MFIN, and the actions taken still materially impact MFIN’s financial statements today primarily through $171 million in Goodwill and Intangibles at 4Q23. Even though Goodwill and Intangibles are by definition not directly tied to a physical asset value, they still meaningfully impacted MFIN’s equity ratios and represent 50% of stockholders’ equity. A Goodwill impairment would have real consequences on the income statement and balance sheet. We believe that the SEC lawsuit overhang will make most institutional and retail investors reluctant to invest in MFIN stock or debt, and if MFIN is forced to raise equity or debt in the future, it could be very costly. Please visit and sign-up at www.restoretheshine.com for updates and more details on the SEC case and why we believe it is a big concern.

The Five Steps to maximizing value.

We know how to execute, how to “block and tackle” and how to hold management accountable. There is the danger of trying to fix everything, so we have focused on the most impactful and easily fixable issues facing the Company, outlined through 5 basic steps. These 5 Steps are outlined in detail at www.restoretheshine.com/5- steps.

Step 1 – Enhance the Board.

Add Directors with relevant banking, consumer lending and capital markets experience that will answer to stockholders and hold management accountable.

Step 2 – Resolve the SEC Complaint.

Remove the biggest obstacle to regaining credibility with investors and give stockholders the ability to quantify the financial impact of the lawsuit on their investment.

Step 3 – Improve the Management Team.

Bring in a professional, slimmed down management team that has credibility with investors and can guide the company to long-term success.

Step 4 – Cut Expenses.

Reduce unnecessary expenses to increase profits to stockholders and to be better prepared for a possible economic slowdown and/or lower consumer demand.

Step 5 – Go on Offense.

Get rid of distractions, focus on the core consumer lending business and invest in technology so that MFIN can better compete in an ultra-competitive consumer lending environment. We believe that MFIN has tremendous potential, and even though the next 9-15 months may be difficult, with the right team in place MFIN could handsomely reward its stockholders and all stakeholders in the long run. MFIN must be proactive in reducing risk and cannot afford to be reactive like it was 6 -10 years ago. But we believe this can only happen if you support our Board nominees and demand a change. Strong leadership starts with the Board, who should be looking out for all stockholders and by extension all stakeholders. They should not be looking out for themselves or management and should reward TRUE performance that leads to long-term value creation.

Please go to our website www.restoretheshine.com for more information on our candidates and our strategy. We will also publish a helpful video on filling in your proxy card under “How to Vote” on our website. We have a comprehensive FAQ section and biography information on our two excellent Board candidates. Our website will provide details on our campaign, updates and sign-up information for stockholders and interested parties. Please reach out to me directly if you have any questions on the data I have presented at info@restoretheshine.com.

Thank you for your time and we appreciate your support.

Sincerely,

/s/ Stephen Hodges

Stephen Hodges

President, ZimCal Asset Management

Manager, BIMIZCI Fund LLC

BIMIZCI as Manager, Warnke Investments, LLC

Source:

https://www.sec.gov/Archives/edgar/data/1000209/000089706924000993/exhibit1.pdf