Autodesk, Inc.

One Market Street, Ste. 400

San Francisco, California 94105

Attn: Stacy Smith, Non-Executive Chair of the Board

Board of Directors

Dear Stacy and Members of the Board,

As you know, Starboard Value LP (together with its affiliates, “Starboard” or “we”) is a large investor in Autodesk, Inc. (“Autodesk” or the “Company”), with a current stake valued at more than $500 million. We believe Autodesk is fundamentally a high-quality business. Unfortunately, we have significant concerns regarding the Company’s operations, governance, oversight and accountability to shareholders. At its core, we believe Autodesk’s issues are a result of the Board of Directors’ (the “Board”) failure to provide appropriate oversight of management, despite years of underperformance.

We are writing to you today to highlight shareholders’ disappointment and dissatisfaction with Autodesk’s wholly inadequate response to the serious disclosure and governance issues that were recently disclosed as part of the findings of the Company’s Audit Committee Investigation (the “Investigation”), which came after years of subpar operational and financial performance. Furthermore, we are concerned the Company is perpetuating a misleading narrative that “all is well” at Autodesk in order to maintain the status quo. We strongly urge the Board to be transparent with shareholders regarding the misdeeds that took place, including disclosing all who were responsible, and to ensure that changes are made to rebuild shareholders’ trust and confidence.

We have received overwhelmingly positive feedback from the investment community since publishing our public letter to Autodesk shareholders on June 17, 2024. Our fellow shareholders have consistently conveyed frustration with the Company’s operational and financial performance, a lack of confidence in Autodesk’s management team, and serious concerns regarding the Company’s poor corporate governance following these recent disclosures.

We have also been pleased at the positive response from Wall Street research analysts, many of whom have noted our involvement as a positive development and highlighted the opportunity for significant operational improvement at Autodesk, following years of underperformance.

In the five years preceding our involvement, Autodesk’s share price significantly underperformed design software peers, the broader software market, and the overall market, as shown below.

Since the issuance of our public letter last week, Autodesk’s share price has risen by approximately 6%, driven by shareholders’ excitement and expectations regarding the potential for improved accountability and performance. We believe there is substantial opportunity for improvement at Autodesk. Autodesk has unfortunately now set a low bar, but the Company, its shareholders, and its employees deserve better. Autodesk should have best-in-class operations and governance, which we believe will drive significant value creation.

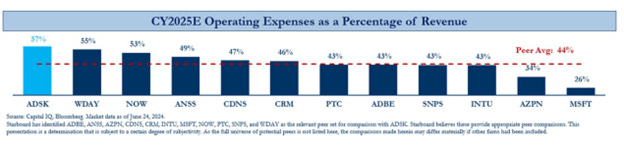

As we have previously written, we believe Autodesk can significantly improve its combination of growth and profitability through substantial margin improvement. Autodesk generates best-in[1]class gross margins, but despite this enviable starting point, the Company’s adjusted operating margins are subpar because the Company outspends its peers on operating expenses, as shown below.

We believe Autodesk can significantly reduce expenses in multiple cost centers and drive improved operating leverage to generate significant margin expansion. In our view, Autodesk can improve its operating margins by at least 1,000 basis points.1 Based on our diligence, the largest opportunity to reduce costs lies within the Company’s sales and marketing organization, where Autodesk spends considerably more as a percentage of revenue than its peers.

By executing upon a margin improvement plan, we believe Autodesk can begin to rebuild investor confidence, which has cratered as the Company has continually missed its commitments (and is expected to continue doing so). As an example, Autodesk missed each of the below FY2023 financial commitments that were made at previous Investor Days.

1 Reflects margin improvement on a like-for-like basis (i.e., excluding the impact of the announced agency model transition).

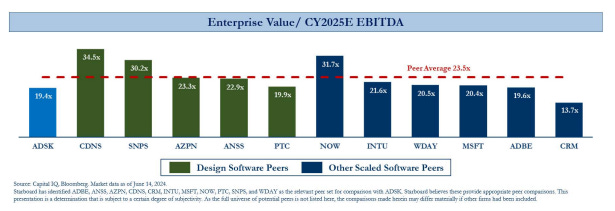

As a result of this poor performance and investors’ lack of confidence, Autodesk trades at a significant discount to its peers, despite our view that it is a higher-quality business than many of the companies shown below.

This discounted multiple should serve as a stark indication to management and the Board that shareholders have less confidence in Autodesk’s future performance relative to peers. We do not believe this should be the case. If the Company can focus on improved operational execution with proper oversight and accountability, we believe the Company’s combination of growth and profitability should improve materially and result in a premium valuation.

Despite the Company’s lengthy history of underperformance, Autodesk’s Board has not taken meaningful action to alter the status quo and hold management accountable for disappointing operational execution, creating serious concerns around the Company’s governance. More recently, shareholders’ concerns regarding Autodesk’s performance and governance were exacerbated as Autodesk acknowledged that its management team intentionally misled investors about billings practices to manipulate free cash flow in an attempt to reach certain financial targets.

As the Board is well aware, as early as FY2018, the Company began transitioning large enterprise customers from multi-year, upfront billings to annual billings. This transition from multi-year, upfront billings to annual billings results in a headwind to free cash flow, and in FY2022, then[1]CFO Deborah Clifford stated to investors that Autodesk expected the transition would be complete by FY2023.

Following the Investigation, it is now clear that Autodesk’s actual billings practices were the opposite of what it had communicated to investors. Instead of billing all enterprise customers annually, and while telling investors it was doing so, Autodesk reverted to its old practice of pursuing multi-year, upfront billings with enterprise customers and did so at a substantially higher rate than historically – all in an apparent attempt to artificially raise reported free cash flow.

In fact, Autodesk explicitly admitted to this misleading behavior in its May 31, 2024 Form 8-K filing, stating:

“During fiscal year 2022, the company announced that it had begun to shift enterprise customers to contracts billed annually, and that it had assumed fiscal 2023 enterprise contracts would be billed annually. The company subsequently determined, however, 5 to pursue multiyear upfront contracts with enterprise customers to help meet its fiscal year 2023 free cash flow goal. Upfront billings of enterprise customers in fiscal year 2023 substantially exceeded historical levels, helping the company to meet its lowered annual free cash flow target.” (Emphasis Added)

It is abundantly clear to us that management took several actions to intentionally mislead investors – these were not accidents. Autodesk had repeatedly informed shareholders about the transition to annual billings for enterprise customers. However, it appears that something changed during FY2023. At that time, at least some members of the Company’s leadership realized that Autodesk would not meet its free cash flow goal, which was a key financial metric for shareholders and a primary metric for executive compensation. These individuals made an active decision to reverse course and change the Company’s business practices to once again focus on multi-year, upfront billings. In fact, we now know that Autodesk actually proceeded to book business with multi-year, upfront billings at an even higher rate than it had historically. We believe these highly-concerning actions were premeditated and show that the Company actively and intentionally misled shareholders – evidencing a severe lack of proper governance.

Moreover, the ramifications of the Company’s misdeeds have been far-reaching – the Company is currently the subject of investigations by the SEC and the U.S. Attorney’s Office, and its Annual and Quarterly filings were severely delayed. Unfortunately, shareholders paid the price for the Company’s actions, as Autodesk’s share price declined by more than 20% from the initial disclosure of the Investigation until the findings were released. Notably, the share price still has not fully recovered to those levels, despite the recent increase following our involvement.

Shockingly, there have been effectively no consequences and no accountability for those involved in this purposeful misleading of shareholders. The then-CFO was removed from her role only to be immediately appointed to the newly created role of Chief Strategy Officer, and the then-Chair of the Audit Committee was named Interim CFO. To summarize, management made active decisions to mislead shareholders and the purported consequence of those actions was to create an extra executive level position for the former CFO. How does this make sense?

Furthermore, we find it almost impossible to believe there were not more members of management, and potentially the Board, who were aware of these issues. Are shareholders supposed to believe that the CFO alone decided to switch enterprise customers back to multi-year, upfront billings, informed the sales team of this decision, and contacted customers to change their terms, all without the knowledge of any other members of management or the Board? If the CFO did act alone, the Company surely would not have re-assigned her to be the Chief Strategy Officer. We, as shareholders, find it hard to believe she acted alone. Why has there been no disclosure of who else was involved, much less any consequences? Where is the accountability to shareholders? It is almost impossible to convey the lunacy of the lack of ramifications for these actions. Our fellow shareholders have rightfully expressed shock at the lack of accountability at Autodesk. We expect public company executives to conduct business in the manner that has been disclosed to the shareholders and to provide accurate disclosures. Further, we expect Board members to provide proper and capable oversight to ensure accountability.

Instead, Autodesk’s management team and Board appear to be perpetuating the narrative that the Investigation has concluded with no restatements of previously issued financial statements required, thereby implying that everything is fine. We believe this implication is patently false and yet another instance of the Company misleading shareholders. The Investigation focused on free cash flow and adjusted operating margin, neither of which are GAAP figures. The fact that there is no restatement required does not absolve the purposeful deception. The findings of the Investigation revealed that the Company misled shareholders with its disclosures and took actions to inflate near-term results, not that the technical accounting of its changed business practices was incorrect. Lastly, not needing to restate previously issued financial statements is not a bar to which any company, much less one of Autodesk’s quality, should aspire. Maintaining the narrative that no restatements were required and everything is fine is a ridiculous and false implication of “victory.” This messaging shows that Autodesk is not focused on transparency and accountability to shareholders, but rather is focused on protecting management and further entrenching the Board.

Changes are needed at Autodesk. Shareholders, the Company, and employees need more transparency and more accountability. Assuming the Board did not know of the Company’s purposefully misleading disclosure regarding its billings practices and that management took these actions without the Board’s knowledge, the Board should be outraged and compelled to take immediate action. The Board should, at the very least, provide shareholders with more transparency around the Investigation, as we believe that the responsible member(s) of management who played a role in perpetuating this false and misleading narrative can no longer be trusted by the Board (or shareholders). If the Board cannot trust an executive, that individual should no longer remain employed by the Company.

If, on the other hand, management was transparent with the Board and at least some members of the Board had knowledge of this misleading disclosure at the time it occurred, then we believe those directors are also culpable and did not adequately perform their duties to represent and protect the best interests of shareholders. If any members of the Board had knowledge of these serious issues for longer than what is implied in the Company’s recent disclosures, we believe those directors should immediately resign from the Board.

We continue to believe that Autodesk is a great company and that it has an opportunity to create significant shareholder value. We look forward to continuing to engage with our fellow shareholders and with the Company in the coming days and weeks ahead.

Sincerely,

Jeffrey Smith

Managing Member

Starboard Value LP

Source: