Dear Fellow Shareholders,

Starboard Value LP (together with its affiliates, “Starboard” or “we”) is a large shareholder of Autodesk, Inc. (“Autodesk”, “ADSK”, or the “Company”), with a current ownership stake valued at more than $500 million. Starboard is an investment management firm that seeks to invest in undervalued companies. Our approach to such investments is to actively engage and work closely with management teams and boards of directors to identify and execute on opportunities to unlock value for the benefit of all shareholders.

We have great respect for Autodesk, a pioneer and leader in design software over the last forty years. Autodesk is the global leader in design, engineering, and entertainment software solutions, with strong market leadership in its core markets of architecture, engineering, and construction . We believe Autodesk has continued runway for growth, with incredibly sticky solutions that are the industry standard and integral to how its customers work, as well as an opportunity to expand further into attractive new verticals, such as construction. We also believe Autodesk has an opportunity to create significant shareholder value by meaningfully improving its combination of growth and profitability through substantial margin improvement, as well as adopting more shareholder-friendly capital allocation policies and improving governance and oversight.

Despite our belief in the strong long-term prospects of Autodesk, we have significant concerns with the Company’s operations, governance, oversight, and accountability to shareholders, given its lengthy history of missed commitments and underperformance from an operational and financial perspective.

Our concerns were exacerbated by the recently disclosed findings from the Company’s Audit Committee Investigation (the “Investigation”) into Autodesk’s accounting and disclosures. The Investigation’s findings raise significant issues and questions about the Company’s accounting and disclosure practices, executive compensation practices, and oversight, or a lack thereof, from the Board of Directors (the “Board”). Even more concerningly, it appears that the Board chose to withhold material information from shareholders ahead of the nomination deadline in order to preserve the status quo and insulate the incumbent directors from a potential challenge by shareholders.

Troubled by these issues, we have attempted to engage constructively and privately with Autodesk in recent weeks. We communicated our concerns regarding the findings of the Investigation and the Board’s decision to refrain from sharing material information with shareholders during the nomination window, as well as the Company’s operational underperformance. We expressed our 2 view that Autodesk’s Board would benefit from new directors that would bring fresh perspectives and provide shareholders with increased comfort regarding the Board’s independence and focus on shareholders’ best interests. We informed Autodesk that we were open to either working with the Company to improve the Board or to the Company reopening the nomination window so that shareholders could make a fully informed decision following recent disclosures. Unfortunately, Autodesk chose not to engage on either of these reasonable paths.

As such, we are filing a lawsuit today in the Delaware Court of Chancery. Our lawsuit asks the Delaware Court of Chancery to compel the Company to delay Autodesk’s 2024 Annual Meeting, which is set for July 16, 2024, and reopen the nomination window such that all shareholders will have an opportunity to make an informed decision on whether this is the right Board to oversee the Company on behalf of the shareholders.

Autodesk’s recently concluded Investigation makes clear the extent to which the Company misled shareholders. The findings of the Investigation show that Autodesk intentionally misled investors on its billings practices as it manipulated free cash flow. The Company reports free cash flow as a key operational metric and uses it as one of the primary determinants of executive compensation.

As early as FY2018, the Company began transitioning large enterprise customers from multi-year, upfront billings to annual billings. As explained by management and widely understood by investors, the transition from multi-year, upfront billings to annual billings would result in a headwind to free cash flow. In FY2022, then-CFO Deborah Clifford provided an update to investors noting the Company was emphasizing its transition to annual billings for enterprise customers and expected the transition would be complete by FY2023.

“Our strong start to the year means we're also shifting more of our EBA customers from multiyear paid upfront to annual billings, which is good for them and good for Autodesk... While we had already assumed this change in fiscal '23, it has a modest impact on fiscal '22 billings and free cash flow... Most EBAs are already on annual billing terms. And also, we had already assumed that EBAs would all be on annual billing terms starting next year in our fiscal '23. We're making the change now because with the strong start to fiscal '22, we decided to get moving earlier to execute on the shift.” (Emphasis Added)

- CFO Deborah Clifford Q2 FY2022 Earnings Call

Following the Investigation, it has now come to light that the Company’s actual billings practices differed materially from what it had communicated to investors. Autodesk disclosed that instead of billing all enterprise customers annually, and while telling investors it was doing so, the Company reverted to its old practice of pursuing multi-year, upfront billings with enterprise customers and did so at a substantially higher rate than historically – all in an attempt to artificially raise reported free cash flow. The Company stated in the principal findings of the Audit Committee Investigation as disclosed in its May 31 Form 8-K that, “During fiscal year 2022, the company announced that it had begun to shift enterprise customers to contracts billed annually, and that it 3 had assumed fiscal 2023 enterprise contracts would be billed annually. The company subsequently determined, however, to pursue multiyear upfront contracts with enterprise customers to help meet its fiscal year 2023 free cash flow goal. Upfront billings of enterprise customers in fiscal year 2023 substantially exceeded historical levels, helping the company to meet its lowered annual free cash flow target.” (Emphasis Added)

This was a clear case of a company saying one thing to investors and doing something completely different. Autodesk had an obligation to not mislead investors with its public commentary, but instead of honoring this obligation, Autodesk did the opposite – the Company told investors it was at the tail-end of a process to move enterprise customers to annual billings. The Company went to great lengths to discuss that it was better for the Company to move to annual billings to reduce discounts and to have more consistent cash flow, among other reasons. Instead, when the Company realized it would struggle to reach its free cash flow targets (which were set expecting annual billings), the Company reverted to discounts for multi-year, upfront billings, as well as other actions, to accelerate free cash flow. The Company continued to report these free cash flow results with multi-year, upfront billings while explicitly and implicitly leading shareholders to believe they had moved enterprise customers to annual billings. It would appear the Board finally realized this issue in the beginning of March when it began its investigation. The Board knew this was material enough to inform the SEC, but conveniently decided it was not material enough to inform shareholders in a timely manner. Instead, Autodesk waited almost a month to inform shareholders of the Investigation on April 1, 2024, so as to avoid the risk of a shareholder submitting a nomination during the nomination window. This is not right.

Furthermore, we have significant questions about the impact these actions had on executive compensation. The Company’s May 31, 2024 press release stated, “[t]hough free cash flow was one factor in the company’s executive compensation program, these decisions were not calculated to influence compensation outcomes.” However, if free cash flow is one of the key metrics in calculating executive compensation, and these actions were taken to artificially increase free cash flow in FY2023, how could they have no impact on executive compensation?

While these issues were uncovered during the Audit Committee Investigation, they are not solely accounting issues – they are issues related to disclosure, oversight, and trust. How can investors have any trust or confidence in a management team that misled them in this way or in a Board that first failed to properly oversee management and protect shareholder interests and then chose to further mislead shareholders by delaying the disclosure of these material issues?

Moreover, the manner in which the Board has dealt with the Investigation and its findings are equally disconcerting and problematic. The Board determined that Ms. Clifford could no longer continue as CFO. However, Autodesk management then appointed Ms. Clifford to the newly created role of Chief Strategy Officer. 1 This series of decisions again raises serious questions – if the Board determined the CFO could no longer serve as CFO, why would a new role be created for that executive? It is almost impossible to believe that another company would immediately hire Ms. Clifford to be its Chief Strategy Officer after she was removed from the Autodesk CFO position. So, how is it possible that Autodesk needed to create this new position of Chief Strategy 1 Source: Bloomberg. “Autodesk Surges by the Most in Over a Year After Reassigning CFO” June 3, 2024. 4 Officer and needed to appoint Ms. Clifford into that position? One would have to ask why this was done, as it does not appear to be a sound or solely business-related decision. Furthermore, shareholders deserve to know which other executives knew about these issues. Given that the issues relate more to changes in business practices, customer relationships, and investor communications than pure accounting, it is reasonable to wonder how knowledge of these issues could be limited to solely the CFO.

We believe the Board has acted to disenfranchise shareholders. The Board commenced the Investigation in early March 2024, well ahead of the March 23, 2024 nomination deadline. Autodesk decided, while knowing this material information, not to make any disclosures to shareholders about these issues until April 1, 2024, nine days after the nomination deadline had lapsed. However, Autodesk did voluntarily inform the SEC about the Investigation on March 8, 2024, a full two weeks ahead of the nomination deadline, and more than three weeks ahead of informing shareholders.

The Board knew the information in its possession was material enough to inform the SEC. At best, the Board was complicit with management in choosing to delay disclosure to shareholders in order to conveniently delay the announcement until after the nomination deadline. The Board had realized that management was misleading shareholders on its reported free cash flow metric and then chose to allow shareholders to remain misled for an additional three weeks, while at the same time also delaying disclosure of its accounting investigation so as to avoid a potential dissident nomination.

For these reasons, we believe Autodesk should delay the 2024 Annual Meeting and reopen the nomination window to give all shareholders the ability to nominate director candidates. Shareholders need to be confident the Board is actively protecting and representing their best interests, and we believe appointing new directors to the Board is a key part of rebuilding that confidence.

As described above, Autodesk’s Investigation prompts serious and severe questions around the Company’s leadership, business practices, governance, and communications with shareholders. While these issues are unfortunate in and of themselves, we are highly concerned that they appear to be symptomatic of a troubling lack of oversight and accountability to shareholders by the Board. We believe this broader issue is also the root cause of the Company’s history of repeatedly missing financial commitments, severe share price underperformance, and subpar operating performance.

At its March 2019 Investor Day, the Company laid out various long-term financial targets for FY2023, including adjusted operating margins of ~40% and $2.4 billion in free cash flow (free cash flow has been an important metric for the Company). Autodesk also committed to revenue growth plus free cash flow margin in the range of 55% to 65% by FY2023. Management reiterated these targets at its subsequent June 2020 Investor Day, while adding that Autodesk expected to grow revenue at an annualized rate of 16-18% from FY2020 to FY2023. At the September 2021 Investor Day, management again committed to its FY2023 financial targets, slightly modifying them only to account for recent M&A. In addition, the Company also added that it expected to grow free cash flow at a “double digit” CAGR from FY2023 to FY2026, implying at least $3.2 billion in free cash flow by FY2026.

Despite committing to these targets repeatedly over the course of multiple years, the Company ultimately missed the midpoint of all of its FY2023 targets.

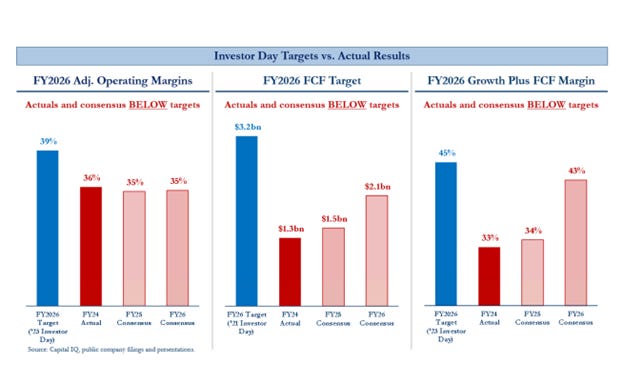

After missing these targets, Autodesk simply lowered the bar for its next set of financial targets. Specifically, at the March 2023 Investor Day, the Company lowered its target for revenue growth plus free cash flow margin from 55-65% (originally targeted for FY2023) to just 45%+ by FY2026. The Company also lowered its expectations for profitability – while Autodesk previously targeted 40% adjusted operating margins by FY2023, it lowered and delayed its target to 38-40% by FY2026.

Unfortunately, based on consensus estimates, Autodesk is currently expected to miss these lowered targets in FY2026, as shown below.

3 Based on $2.4bn FY2023 FCF target and “double digit FCF CAGR” from FY2023 to FY2026 target.

As a result of the Company’s subpar performance, Autodesk shareholders have suffered. As shown below, Autodesk’s share price has meaningfully underperformed its peers, the software market, and the broader market over the last five years.

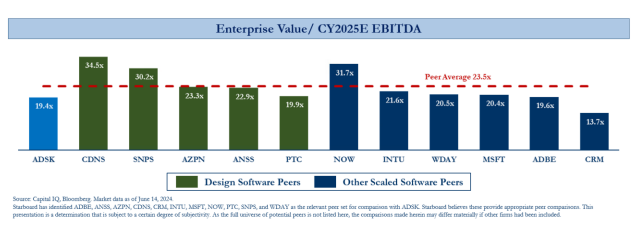

As a result of this poor performance, Autodesk now trades at a meaningful discount to its peer set. We believe Autodesk is a higher-quality business than many of the companies shown below, but it trades at a lower multiple given its subpar execution, investors’ lack of faith in improved execution going forward, and concerns over the Board’s ability to provide oversight and its willingness to hold management accountable.

As mentioned earlier, we believe Autodesk has an opportunity to meaningfully improve its operational performance and rebuild investor confidence. We believe Autodesk can significantly improve its combination of growth and profitability over the next few years.

Autodesk occupies an enviable position in the design software category, an attractive segment of the broader software market. As a result of its strong market position and attractive business model, Autodesk generates best-in-class gross margins. Despite a meaningful gross margin advantage, however, Autodesk’s adjusted operating margins are subpar because the Company outspends its peers on operating expenses. We believe Autodesk can significantly reduce expenses in multiple cost centers and drive improved operating leverage to generate significant margin expansion.

In addition, we believe Autodesk can adopt more shareholder-friendly capital allocation policies, increasing the amount of capital it returns to shareholders through share repurchases. We also believe Autodesk should refrain from any material acquisitions unless and until it can execute with excellence. Given the Company’s current valuation and our belief in the value creation opportunity at Autodesk, we believe repurchasing its own shares represents the best use of capital for Autodesk today.

By taking these actions, we believe Autodesk can drive significant growth in Adjusted EBITDA, free cash flow, and free cash flow per share over the next few years, which we believe will drive significant long-term shareholder value.

We firmly believe the Board needs to be enhanced in order to provide investors confidence that Autodesk will execute on this plan and do so with the proper focus on shareholder interests. The current Board has overseen numerous issues, each of which would be enough to cause concern and merit change. Taken in totality, we believe it is clear that change is warranted and required on the Board to provide objectivity without the burden of attachment to past decisions and increase accountability to shareholders.

While we have unfortunately been forced to take legal action in an attempt to protect shareholders’ rights, our primary goal remains to help create long-term value for the benefit of all Autodesk shareholders. Shareholders have a sacred right to elect a board of directors that is focused on their best interests. We look forward to discussing these topics, among others, with our fellow shareholders.

Sincerely,

Jeffrey Smith

Managing Member

Starboard Value LP

Source: