Politan Details Why a Truly Independent Board is Urgently Needed at Masimo in Order to Protect Shareholder Value and Realize the Company’s Full Potential

$MASI

Dear Fellow Masimo Shareholders,

Politan owns 9% of Masimo – an approximately $600 million investment that makes us one of the Company’s largest shareholders. We invested in Masimo over two years ago because we believe in the Company’s tremendous promise. However, it has become clear that to protect shareholder value, let alone realize Masimo’s potential, the Company needs a majority of truly independent directors. This is why we have nominated to the Board Darlene Solomon, former Chief Technology Officer of Agilent, and Bill Jellison, former Chief Financial Officer of Stryker – two unquestionably independent nominees who bring crucial expertise needed in Masimo’s boardroom.

We have made numerous efforts to avoid another proxy contest. Each of our settlement proposals has offered Mr. Kiani the opportunity to remain on the Board. Our offers still stand. Masimo has proposed to seat both Dr. Solomon and Mr. Jellison, but only if we agreed to a separation transaction on the terms that Mr. Kiani had sought earlier this year: Mr. Kiani’s full departure from Masimo in order to serve as Executive Chairman of a newly spun off Consumer Business that would take with it licenses to all of Masimo’s IP, Mr. Kiani’s pick of employees and trade secrets, the Masimo trademark, the corporate headquarters and jet, $150 million in cash and for Mr. Kiani personally the immediate payout of ~$400 million, an entirely new compensation package for his new role and control of the Consumer company either through controlling shares granted to him essentially for free or his personal selection of the Board. We rejected this proposal when it was first made, yet every subsequent Masimo settlement offer has been structured to ensure Mr. Kiani can achieve similar results. Protecting shareholders from the permanent impairment that would result from such transfers of Masimo assets is one of the reasons why shareholders voted Michelle Brennan and me on to Masimo’s Board last year, and the fact that Masimo’s other directors would condone these types of transfers underscores why further change is needed in the boardroom.

As a result, the only option left open to us is to bring our concerns directly to shareholders. Last year, shareholders overwhelmingly elected us to Masimo’s Board. Yet, Mr. Kiani and his selected directors ignored the vote results and refused to repair Board oversight. Instead, they embarked on a damaging entrenchment strategy, including the currently proposed separation – a transaction that is not the divestment of Sound United that shareholders want, but instead is a transfer of valuable IP, trade secrets and trademarks to an entity Mr. Kiani will lead. Unfortunately, ignoring shareholder votes and employing extraordinary entrenchment mechanisms is not a new pattern of behavior at Masimo, but rather is one that we believe has continually recurred and worsened over the past decade. The vote this year is likely the last chance shareholders will have to break this cycle and enact meaningful change.

Fundamentally, what this upcoming vote is about is simple: fixing the prolonged and deliberate refusal by Masimo to permit independent oversight. However, in light of the Board’s unprecedented actions, this vote will also have broader reaching implications in establishing what conduct institutional shareholders will tolerate. Consider the following:

·Masimo’s share price has underperformed its own selected peers by over 90% in the past five years: Despite nearly all of its healthcare revenues coming from pulse oximetry products sold into a duopoly market with high barriers to entry and generating significant recurring revenues, Masimo has underperformed all its peer groups over all relevant time periods.

·Governance remains broken at Masimo: The Board does not even see, much less approve, a budget, and information flows to the Board solely at the CEO’s discretion. As a result, the Board is uninformed about basic financials as well as material risks such as regulatory inquiries, whistleblower matters and share pledges by the CEO.

·Lack of Board oversight has resulted in widespread harms to the Company: All Masimo stakeholders have suffered from the Board’s failures, with the share price languishing, growth stagnating, financial targets missed by wide margins, regulatory investigations by the DOJ and the SEC opened, whistleblower lawsuits filed and employee disapproval of the CEO skyrocketing.

·Shareholders have objected to these oversight failures for over a decade, yet the Board’s response has been further entrenchment: Shareholders have voted against Masimo’s directors and Say-on-Pay in extraordinary numbers over the past decade, placing Masimo in the bottom 1% of US public companies year after year. Instead of improving, Masimo’s Board has employed unprecedented entrenchment mechanisms in the form of spinoffs/separations (previously Cercacor, today the “Separation”), change in control payments, bylaw amendments, and a Board structure that has drawn widespread rebuke from Delaware Courts, governance experts and shareholders.

·The proposed Separation poses significant risks and is not the divestment of Sound United that shareholders want: Instead of selling Sound United, whose acquisition has proved disastrous, Mr. Kiani is pursuing a separation of a newly formed entity that will take Masimo’s trademarks, trade secrets and licenses to its IP, thereby risking the creation of a new competitor as a result. There is no proper Board oversight process in place, as Mr. Kiani disbanded the Special Committee formed for this purpose and has only engaged with a single party that he selected without even notifying the Board of the entity’s name until after he signed a term sheet. The last time Mr. Kiani oversaw a spinoff at Masimo, it created Cercacor – resulting in a ~$1 billion value transfer to an entity majority-owned by Mr. Kiani and a poison pill at Masimo that took a decade to get out from under.

·The opportunity at Masimo is immense: While the issues presented above are significant, the opportunity to deliver returns for shareholders is massive. Dr. Solomon and Mr. Jellison can help to refocus Masimo as a growth business targeting 8-10% revenue growth and 35+% EBIT margins and in the process unlock $10+ billion of shareholder value over time. Achieving these results requires a focus on discipline, oversight and shareholder value that has been lacking at the Company and will only come from a majority of truly independent directors on Masimo’s Board.

·This is shareholders’ last chance at meaningful change: For more than two years, Politan has navigated unprecedented impediments thrown up by Masimo’s Board to allow shareholders the opportunity to seat a majority of truly independent directors, and we doubt any shareholder will ever try to do so again. Further, following the 2024 AGM, Mr. Kiani will enter into an irreversible separation transaction with permanent valuation implications. For both of these reasons, we believe this is shareholders’ last chance for meaningful change at Masimo.

Governance Remains Broken at Masimo

When shareholders overwhelmingly elected Ms. Brennan and me to the Masimo Board last year, I was optimistic we could work productively with the rest of the Board to drive positive change. Unfortunately, our efforts were continually rebuffed, as the Board refused to give us basic information, denied us access to management, repeatedly held Board meetings excluding us and refused to even consider allowing any review of capital allocation or strategy. Mr. Kiani and his selected directors have been adamant that no governance changes are necessary. As a result, governance remains broken at the Company.

·Shareholders’ concerns over lack of oversight have driven multiple collapses in Masimo’s share price: In 2022, Masimo’s market value declined by $5 billion after a $1+ billion cash acquisition of Sound United, as shareholders feared destructive capital allocation would continue unchecked. In 2023, the share price declined by 50% as shareholders were concerned management had inflated numbers in advance of the 2023 proxy contest. In 2024, the share price declined 15% as shareholders worried about an SEC subpoena and Mr. Kiani’s comments that he intended to enter a binding separation transaction before the 2024 AGM. Each of these declines reveal the long-simmering crisis of confidence in Masimo’s oversight. See Figure 1.

·There is no oversight of management: The Board does not review, approve or see a budget – only 2% of Masimo’s expenditures are even potentially subject to approval and essentially no expenditure has even made it to the Board for approval for over two years. This results in Mr. Kiani spending whatever he wants however he wants.

·The Board is uninformed: No procedures exist for information to reach directors. Rather, it is provided solely at Mr. Kiani’s discretion. As new directors, our repeated requests for basic information and meetings with senior management were consistently denied even in the wake of the stunning Q2 2023 sales decline and Mr. Kiani’s explanation that he was unaware of discounting practices occurring among the sales force. The Board was also effectively not informed of material risks like the DOJ and SEC investigations, the whistleblower lawsuit involving sixteen former employees and Mr. Kiani’s recent pledging of 75% of his stock ownership as collateral for a personal loan.

·There was no legitimate Board expansion process, and Chris Chavez represents more of the same: Directly contrary to management’s public comments at the time that a director search was underway, for the first three months following the 2023 AGM the search firm was officially placed on hold and the Nominating Committee did not meet even once. Only after the Company realized it would miss Q3 2023 earnings did a pro forma window-dressing search process quickly commence and conclude. The result was adding directors the legacy Board had selected in March 2023, prior to the 2023 AGM in June. Mr. Chapek was never identified by a search firm, but rather was an acquaintance of Mr. Kiani’s, proposed by him and placed in the 2026 class of directors so that he would not be up for a shareholder vote for nearly three years. Similarly, Mr. Chavez was never identified by a search firm, but rather is a 20+ year acquaintance of Mr. Kiani’s and proposed by him. While Mr. Kiani claims to hardly know him, the fact is that the Masimo Foundation’s only investment in the last five years was in Mr. Chavez’s company (which went bankrupt).

·Mr. Kiani’s selected directors firmly control all aspects of the Board: Mr. Reynolds, like Mr. Chapek, was selected by Mr. Kiani to join the Board. Despite being nearly voted off the Board when he was last up for election in 2022 and ranking in the bottom 1st percentile of any public company director in voting support during his decade tenure, Mr. Reynolds is the Lead Independent Director and Chair of every Board committee. Mr. Reynolds and Mr. Chapek together make up a two-thirds majority of each Board committee and, along with Mr. Kiani, comprise a majority of the Board. Notably, Masimo’s committee charters place authority for deciding Mr. Kiani’s compensation with the Compensation Committee. The full Board has never voted on or even been briefed on any aspect of CEO compensation.

Broken Governance Has Resulted in Significant Harms for Stakeholders

The Board’s oversight failures have harmed shareholders, employees and patients. While Masimo’s share price, financial performance and operations have declined, its regulatory risks and employee dissatisfaction with the CEO have risen. See Figure 2.

·Employee disapproval of Masimo’s CEO is the worst in the industry: Based on Glassdoor data6 that allows employees to assess their CEOs without fear of retribution, Mr. Kiani is the lowest rated CEO of any peer in the industry by a substantial margin. The second worst is viewed 32% more favorably than Mr. Kiani and the industry median is nearly 100% more favorably viewed.

·Consistently missed financial targets and a failed consumer strategy: Masimo has not come close to the targets laid out at the December 2022 Analyst Day, missing 2023 targets for revenue and EBIT by 13% and 27%, respectively. Current 2024 guidance contemplates similar or worse misses for revenue and EBIT of 17% and 31%, respectively. Management in 2017 said they expected to achieve 30% operating margins within a “few years” but now, seven years later, they are still aspiring to 30% margins – albeit not until 2029, more than a decade after first introducing the target. Sound United revenue and EBIT have declined since the acquisition by 22% and 49%, respectively, and the all-cash, debt-financed transaction is now dilutive. In addition to the $1+ billion Sound United price tag, Masimo has spent approximately ~33+% of its earnings on Consumer Healthcare only for its products to completely fail: the Freedom Watch cannot be launched due to manufacturing bugs and Stork revenue is ~$0.

·Multiple investigations by regulators and lawsuits by whistleblowers: In the past four months, Masimo has received multiple DOJ subpoenas regarding its recall processes, an SEC subpoena regarding accounting allegations by multiple employees, and whistleblower lawsuits involving 16 former employees. Incredibly, the Board was not even notified of the March DOJ and SEC subpoenas until more than a month after they were received. Similarly, the full Board only learned of the presence of the whistleblowers when a detailed legal complaint was publicly filed. The Board has no process in place to oversee any of these matters and instead relies solely on the discretion of management to handle them.

·Mr. Kiani’s egregious compensation, lavish corporate spending, related party transactions and concerning stock pledges: Masimo pays Mr. Kiani annual compensation 2x that of peer CEOs, while at the same time paying $19 million annually to Cercacor (where Mr. Kiani is CEO and majority owner). Mr. Kiani also is permitted to spend lavishly on inessential items such as his personal use of a G550 private jet that he has used 56 times in the last two years alone to fly to his personal ranch only a two-hour drive away. Notably, in the months following the collapse in Q2 2023 revenues, the private jet was in Ibiza, Anguilla and Santa Barbara and does not appear to have been meaningfully used, if at all, to visit clients. Additionally, Mr. Kiani pledged $400 million of Company stock, representing 6% of the Company’s shares and 75% of his holdings, as collateral for personal loans without informing, much less getti ng approval from, the current Board about any aspect of the arrangement.

For Over a Decade Shareholders Have Objected, Yet Masimo Refuses to Change and Resorts to Entrenchment

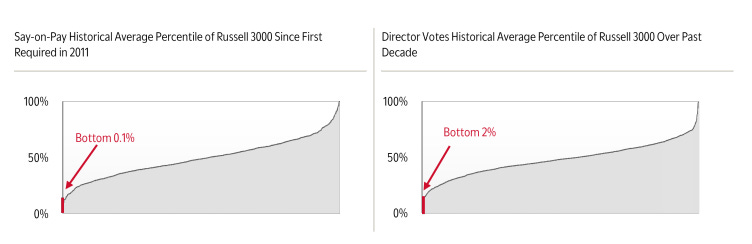

Broken governance harming Masimo is not a new issue. In fact, shareholders have voted against Masimo’s Board in extraordinary numbers for well over a decade. Masimo is in a category all of its own, as the Company ranks last or among the bottom couple percent of all US public companies across numerous governance measures and is unique in ranking so poorly across all of them. See Figure 3.

·The bottom 0.1% for votes against executive compensation: Masimo has ranked in the bottom 0.1% of the entire Russell 3000 for “Say-on-Pay” since such votes were first required in 2011. In six of the last 13 years, Masimo has failed this vote. Only three other companies have had as many failures.

·The bottom 2% for “withhold” votes against Board members: Over the past decade, Masimo shareholders have withheld against Masimo directors at consistently high levels. Only twice during this period has even a single independent director done better than the bottom 33rd percentile. Last year, 84% of shareholders voted against Masimo’s Lead Independent Director, Michael Cohen, thereby removing him from the Board. Nonetheless, Mr. Kiani immediately hired Mr. Cohen back as a paid advisor to the Company and had him attend the October 2023 in-person Board meeting (one of only two that have been held in the past year).

These extraordinarily high votes against Masimo’s Board year in and year out have not resulted in improved governance. Rather, Masimo’s Board has concocted ever more extreme entrenchment devices to avoid shareholder accountability.

·Cercacor separation: When Masimo spun off Cercacor, it placed in what is nominally titled a licensing agreement a trigger that if for any reason Mr. Kiani is not Masimo’s Chairman and CEO, Masimo would owe a minimum royalty payment of $17 million annually to Cercacor (where Mr. Kiani is CEO and majority owner). For nearly a decade this payment was ~30+% of Masimo’s EBIT and served as an effective poison pill entrenching Mr. Kiani’s position at Masimo. Today, Masimo pays Cercacor more than $19 million annually (and therefore has outgrown the impact of the trigger). However, the value of these ongoing payments to Cercacor equates to a ~$1 billion value transfer from Masimo shareholders.

·CEO employment agreement: As part of his 2015 employment agreement, amended in 2017 and 2022, Mr. Kiani received an enormous $400+ million change in control provision (at current value) with a single trigger tied to minority changes in Masimo’s Board. Last year a Masimo director acknowledged in a deposition that he hadn’t even bothered to read the agreement when he approved it. Mr. Kiani agreed to waive a portion of these provisions after a Delaware judge wrote, “This is an astounding amount of consideration…truly amazing…[these provisions] preclude the board from exercising its statutory and fiduciary duties to manage the corporation in the best interests of the corporation and its stockholders, and thus amount to abdication… I’m not sure that for a lot of these provisions, and certainly for them together… there really is a parallel.” The judge went on to note, “these extraordinary change of control provisions were stuffed in what is otherwise titled a compensation agreement.” While Politan decided to drop the litigation without prejudice shortly after joining Masimo’s Board, we believe the remaining provisions would not be upheld in court. Because we have made a standing offer and the Company retains the ability to add Mr. Kiani back to the Board following the election of Dr. Solomon and Mr. Jellison, we believe Mr. Kiani’s change in control provision is not implicated in this year’s election, irrespective of whether Mr. Kiani decides to rejoin the Board.

·Advance notice bylaw amendments: In 2022, Masimo adopted preclusive bylaw amendments – described by ISS as “an affront to shareholders” – in an attempt to block shareholders such as Politan from nominating directors. Directors under deposition acknowledged they adopted the provisions because they believed they would lose a proxy contest with Politan. Politan had to go to court to remove the bylaws with the Delaware judge noting, “There should be zero doubt, however, that the repeal of the challenged advance notice bylaws provisions here had remarkable value and was, frankly, an extraordinary corporate benefit.”

Separation Transaction Poses Significant Risk to Shareholders and Epitomizes Problems Plaguing the Company

Politan, like nearly all Masimo shareholders, would like to see a clean exit from the disastrous Sound United acquisition. However, Mr. Kiani adamantly refuses to do this and continues to insist the acquisition has been the right decision. The announced Separation that Mr. Kiani is pursuing should not be viewed as synonymous with selling Sound United – instead, it is a transfer of valuable IP licenses, trade secrets and trademarks that could permanently impair Masimo’s valuation and create a future competitor while personally benefiting Mr. Kiani.

·Mr. Kiani has continually sought a Separation that risks permanently impairing Masimo: In multiple different proposals this year, Mr. Kiani has sought a Separation allowing for his full departure from Masimo in order to serve as Executive Chairman of a newly spun off Consumer Business that would take with it licenses to Masimo’s IP, the Masimo trademark, Mr. Kiani’s selection of engineers who would bring trade secrets with them, the corporate headquarters and jet, $150 million in cash and provide Mr. Kiani personally the immediate payout of $400+ million, a new compensation agreement for his new role and control of the Consumer company either through controlling shares granted to him essentially for free or his personal selection of the Board.

·Masimo’s Board formed a Special Committee that refused to accept Mr. Kiani’s proposal, so Mr. Kiani dissolved the Special Committee: The Board established a Special Committee in February which hired Sullivan & Cromwell LLP and Centerview Partners to evaluate a potential Separation of Masimo’s Consumer Business. After doing significant analyses aided by these blue-chip advisors, the Special Committee found that granting licenses for consumer applications of Masimo’s IP carried significant risk for Masimo and could result in a substantial valuation overhang. As the site of clinical care shifts out of the hospital and into the home in the future, Masimo would find itself competing with the Consumer entity as the line between the hospital-at-home and consumer market is a thin one and evolving.

The Special Committee returned to Mr. Kiani a term sheet that rejected or modified many of his demands and proposed a process, overseen by independent directors, to properly determine the field-of-use and boundary conditions for any IP transfers. Ten days later, Mr. Kiani moved to dissolve the Special Committee and publicly announced the Separation.

·Mr. Kiani is pursuing the transaction today with a single counterparty and no actual Board oversight: Mr. Kiani is engaging with a single counterparty he selected to carry out a transaction that raises the exact same IP concerns and similar related party concerns the Special Committee objected to. There is no broader process considering any other counterparties or alternatives such as a sale of Sound United. Further, Mr. Kiani has kept the Board completely in the dark. He signed an NDA with the counterparty on March 20th without ever informing the Board that discussions were occurring or even that the counterparty existed. It was only on May 13th, after Politan made a 220 demand, that Mr. Kiani shared with the Board a copy of a signed term sheet that had already been entered into by Mr. Kiani and the counterparty. Since then, Board members have received limited updates relating to the transaction. Beyond the term sheet, all we know is that Mr. Kiani intends to be Chairman of the new entity and has an understanding that the counterparty views Mr. Kiani’s ongoing involvement in the new entity as essential. Independent directors should not be required to make 220 demands in order to obtain basic information about material proposed transactions.

·Mr. Kiani has done this before, with Cercacor, and it cost shareholders ~$1 billion and a decade-long poison pill: As described above, Mr. Kiani has done this before. The last time Mr. Kiani oversaw a separation, it was the spinoff of Cercacor whose IP licensing agreement served as a valuation overhang on Masimo for many years, carried with it a poison pill embedded in a licensing agreement and ultimately has cost Masimo shareholders approximately $1 billion.

Politan wants a Separation done right. We have been asking for a strategic review of the Sound United business and consumer healthcare spending for over 18 months. All transaction alternatives should be considered, including a straightforward sale of Sound United. There are complex questions that must be appropriately overseen by independent directors around issues like intellectual property, trademarks, trade secrets, the Apple Litigation, and how such a transaction could trigger provisions of Masimo’s licensing agreement with Cercacor. A transaction led by Mr. Kiani without true independent oversight would be irreversible and pose significant risk to Masimo’s shareholders in both the near and long term.

Shareholder Nominees Can Safeguard Shareholder Value and Deliver Substantial Share Price Appreciation

We believe that Masimo urgently needs a truly independent Board to safeguard shareholder value and realize the Company’s full potential. This is why Politan worked with an independent, nationally recognized executive search firm to identify two directors that have no pre-existing relationship with Politan or Masimo and who bring crucial expertise that is sorely needed on the Board.

·Dr. Darlene Solomon, former CTO of Agilent Technologies, Inc. (NYSE: A), brings deep expertise in R&D strategy, a successful public board track record and experience overseeing three large scale, successful separation transactions requiring critical expertise in the division of IP and retention of technical talent. Darlene is currently an independent director at Materion Corporation (NYSE: MTRN) and Novanta Inc. (Nasdaq: NOVT). She is ideally suited to help Masimo navigate a separation of its Consumer Business and the associated IP division and technical talent retention matters in a manner that maximizes value. She can also support the Company in aligning its product portfolio and R&D pipeline to realize its long-term growth potential.

·William (Bill) Jellison, former CFO of Stryker Corporation (NYSE: SYK), brings deep medical technology executive capability, successful public board experience and a strong track record of value-creating capital allocation including significant transaction expertise. Bill is currently an independent director at Avient Corporation (NYSE: AVNT) and Anika Therapeutics, Inc. (Nasdaq: ANIK). He is ideally suited to chair the Audit Committee, as Masimo has not had an experienced audit chair in over five years, and could help oversee cost structure optimization efforts and the alignment of spending to long-term growth plans.

***

While the issues outlined in the letter above are significant, the opportunity to deliver returns for shareholders is immense. We have released a 160-page presentation with significant details laying out the tremendous opportunity we see to unlock approximately $10 billion of value by refocusing Masimo as an innovation-led growth company focused on its core hospital and hospital-at-home markets, thereby targeting a reacceleration to 8-10% annual revenue growth and an optimized cost structure that supports investment in successful product launches and delivers 35+% EBIT margins. Importantly, these changes will better position Masimo to improve patient outcomes – as we cannot further help patients if our new products are not selling. In addition, our 35+% EBIT margin goal contemplates R&D spend that is higher than the long-term levels targeted by Mr. Kiani just last month. For years, Masimo has repeatedly promised new product revenue that never materializes and margin expansion which seems to constantly take two steps back for each one step forward. After the July 25th AGM, Masimo can finally have an experienced, independent Board of successful medical-tech executives that eagerly want to hear from, learn from and empower Masimo’s employees. And with that, Masimo can finally deliver for its shareholders and stakeholders.

Electing only one of our two nominees would not be sufficient to effect this type of change. Adding just Dr. Solomon or Mr. Jellison would result in a deadlocked Board – something broadly criticized by governance experts and which would merely continue the status quo under which Mr. Kiani can do whatever he wants however he wants with no effective Board oversight.

Between now and the shareholder vote, you are likely to hear from Masimo that Politan’s “agenda” would irreparably disrupt the Company and cause the exit of Mr. Kiani, which would be an existential threat to Masimo’s future. This is false. First and foremost, we have repeatedly made clear that we are willing to work with Mr. Kiani if he can accept truly independent oversight. Further, Mr. Kiani does not run the day-to-day healthcare business, and if he does transition out of the CEO role, we have laid out a detailed plan in our investor presentation that would minimize any disruption. Finally, if Mr. Kiani’s departure would be so destructive to Masimo, why was he himself offering his exit to the Special Committee just a few months ago as part of the proposed separation of the Consumer Business? We would also remind shareholders that last year Mr. Kiani promised he would quit the Company if our nominees were elected. This exit obviously did not occur.

You will also likely hear between now and the vote an array of absurd claims attacking anything and everything about Politan – including our motivations at Masimo. Unfortunately, this is simply how Mr. Kiani does business. We ask you to ignore these distractions and focus on the facts. Most importantly, we ask you to focus on the exceptional opportunity at Masimo and the chance this election represents to not only deliver on this opportunity, but also to make clear that shareholders deserve better than the decade of entrenchment tactics and broken governance that has occurred at Masimo.

Sincerely,

Quentin Koffey

Politan Capital Management

Source:

https://www.sec.gov/Archives/edgar/data/937556/000110465924075009/tm2418264d2_dfan14a.htm