Caligan Partners Issues Open Letter to Anika Board

$ANIK

he Board of Directors

Anika Therapeutics, Inc.

32 Wiggins Avenue

Bedford, MA 01730

Attn: Jeff Thompson, Chairman

c/o Dr. Cheryl Blanchard, CEO

Dear Mr. Thompson and Members of the Board of Directors,

As you know, Caligan Partners LP (“Caligan,” “we” or “us”) is a major shareholder of Anika Therapeutics, Inc. (the “Company” or “Anika”), with beneficial ownership of ~4% of Anika's outstanding shares of common stock.

After months of diligence, analysis, and engagement with you, we strongly believe that Anika’s current strategy of incurring heavy losses in the joint preservation segment it acquired impairs the intrinsic value of Anika’s market-leading viscosupplement portfolio, Monovisc and Orthovisc[1].

After patiently engaging with Anika's board of directors (the “Board”) and management team over the past five months, we believe now is the time for a public discussion about Anika's future. We believe that:

1)Anika Has Materially Underperformed its Peer Group & Broader Indices: Despite Anika's well-capitalized balance sheet with ~$90MM in cash, no debt, and positive adjusted EBITDA, Anika’s total shareholder return (TSR) has underperformed both its self-selected peer group[2] and broader indices over all relevant time horizons.

2)Anika’s Underperformance Can Be Attributed to Two Key Issues:

a.Investor concern on the product differentiation and losses in the Company’s Joint Preservation and Restoration (“JP”) segment; and

b.A loss of investor confidence in management after consistently missing JP segment guidance and withdrawing 2024 financial targets.

3)Anika’s Viscosupplement Portfolio Will Not Be Appropriately Valued by Public Markets: Anika’s viscosupplement portfolio, with established, market-leading positions in osteoarthritis and an efficient commercialization strategy, is characterized by low market growth and high profitability, attributes that are more highly valued by private markets than public markets.

Section 1: Anika Has Underperformed Peers and Benchmarks Over Relevant Time Periods

Unlike most public life sciences companies, Anika has a fortress balance sheet and significant profitability from its viscosupplement portfolio. Despite these inherent advantages, the Company’s stock price has significantly underperformed both its self-selected proxy peer group and relevant benchmarks, including the NBI, over all time periods.

Anika's EV/Revenue Multiples are Significantly Below Proxy Peers

Anika trades at one of the lowest EV/Revenue multiple of any of its proxy peers—just 1.6x FY2023 consensus revenue estimates[3]—reflecting what we interpret is the public markets’ deeply cautious view of Anika’s present and future prospects. Four years ago, when Johnson & Johnson (J&J) represented more than 70% of Anika’s total revenues, Anika traded at a 3% valuation premium to its medical device peer group[4]:

However, after the Company announced a new strategy of using cash flows from J&J to fund a strategic pivot into JP at its September 2019 Investor Day, Anika’s forward revenue trading multiple started to collapse, dropping ~68%. Now the Company trades at a ~60% discount to its peers.[5] Due to the low quality and high resource intensity of the assets Anika acquired, investors have punished Anika’s attempts to diversify with a lower trading multiple.

Section 2: Our Observed Reasons For Anika’s Underperformance

Investor Concern Regarding Company’s Losses In Joint Preservation And Negative Returns on Capital

Analysts and investors have noted that the Joint Preservation segment’s products are predominantly made up of less innovative 510k products[6] and have highlighted the segment’s material drag on overall profitability post-acquisitions.[7]

A basic examination of Anika’s financials demonstrates that, even assuming the OA pain management revenue loss post-COVID flowed through to Anika’s bottom line, Anika’s Joint Preservation Segment is operating at a ~$35MM loss annually. We calculate that, just for the segment to break even, Anika would need to grow JP revenue by 150%, with no incremental operating expense. This implies losses for more than a decade for a segment that the Company has guided to grow “low- to mid- single digits” in 2022.[8]

Since FY2015 (when Anika’s revenues from J&J were ~$67MM), Anika has invested ~$300MM of shareholder capital in R&D, acquisitions, and capital expenditures. In FY2022, consensus estimates for Anika’s revenues from J&J are ~$68MM and Anika’s Pre-R&D EBITDA is $28MM less than it was in FY 2015. In other words, Anika’s ~$300MM of investment has resulted in a -9.2% return for shareholders. All while Anika’s most profitable assets—revenues from Monovisc and Orthovisc—haven't changed.

Loss of Credibility

Setting appropriate long-term targets and executing against those targets is essential for any company to build trust with the investment community. At its 2021 Investor Day, more than a year after the COVID-19 pandemic’s impact to its business were well-known, Dr. Cheryl Blanchard, CEO, conveyed management's revenue and EBITDA targets, which implied doubling FY2019's revenue and a 20% adjusted EBITDA margin by 2024.[9]

By March 2022, not even 9 months later, management withdrew these 2024 targets. The reaction from sell-side analysts was predictable with one analyst writing “no sense of an alternative timetable or even a reasonable basis for why the targets remained achievable was provided. Given how often and how confidently the 2024 targets had been discussed and defended by Anika leadership, we think the mere two sentences utilized during the conference call to communicate that the 2024 targets were no longer valid left much to be desired.”[10]

Anika’s shares fell -14.3% on March 9, 2022, the day after withdrawing the 2024 guidance, underperforming the XBI by -19.2%.

Similarly damaging to management credibility and a further indictment of the quality of the JP segment and management’s ability to accurately forecast it, since the Company acquired Arthrosurface and Parcus, Anika has had to cut its initial guidance every single year in the JP segment.[11]

Section 3: Anika’s Viscosupplement Business Will Struggle To Be Valued Appropriately By Public Markets

Anika’s public disclosure surrounding its viscosupplement products is opaque, which we believe causes the public markets to struggle to appropriately value the OA segment. We believe this is because Anika commingles its financial reporting of a high margin royalty stream from the osteoarthritis pain management segment (OA Segment) with the revenues, development, and commercial infrastructure costs of the JP segment. And though Anika mandatorily discloses its total revenue from J&J, the form of that revenue—product sales versus royalty—and associated costs are not specifically enumerated.

Either the public markets are placing an unreasonably high discount rate on the revenue stream from Monovisc and Orthovisc or, contrarily, assuming a reasonable discount rate on Anika’s revenues from J&J, we believe the public markets are currently implying Anika’s JP segment represents NEGATIVE VALUE of ~$400MM (~$26/share).

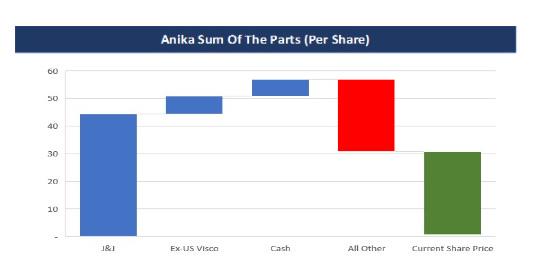

Note: Caligan analysis. J&J revenues valued at 10% discount rate and $68MM revenue run-rate. Ex-US Visco revenues valued at 20% discount rate.

As illustrated above in the sum-of-the parts chart, the upside in addressing the losses in the JP segment is considerable and indicates that Anika can be worth ~$60 per share, more than double the current share price, by exiting the JP segment and removing the associated losses.

Section 4: The Path Forward

Given Anika's perpetual underperformance and significant shareholder capital being wasted in JP, we believe the status quo is untenable and urgent changes are needed. Anika would benefit by evaluating the following options with the help of outside advisors:

1)Exiting Joint Preservation and Returning Capital To Shareholders: Anika’s misguided foray in joint preservation has not generated the revenue growth necessary to justify the heavy losses incurred. Nor, given the repeated guidance cuts, does Anika have any reasonable basis to suggest they can accurately forecast the segment will grow at a level in the future that justifies the current losses. Anika’s shareholders would be better off making their own capital allocation decisions with the profits from the viscosupplement business via share buybacks.

2)Strategic Review: While Caligan strongly believes that public life sciences companies are bought—not sold—the public markets are not appropriately valuing the cash flow of Anika's viscosupplement portfolio. Given the nature of Anika’s most valuable assets, low growth and high profit, Anika may be better positioned as a private company or as part of a larger organization.

3)Fresh Perspectives: Given the current board’s lack of accountability for the shareholder value destruction that has occurred under their watch, we believe that in conjunction with a review of Anika’s strategic options, fresh perspectives are needed. Caligan believes Anika needs new directors on its Board; those who are willing to objectively look at the JP segment and appropriately assess its prospects amongst alternative uses of capital.

Next Steps

We have attempted to engage in constructive discussions with Anika for the last five months, but Anika's Board and management have been reluctant to acknowledge that losses associated with the JP segment have resulted in substantial shareholder value destruction and remain unwilling to consider alternative solutions to improve share price performance.

Therefore, we intend to consider all available options to us, including nominating a slate of well-qualified directors for election to the Board at the Company's 2023 Annual Meeting of Shareholders, who we believe would be positioned to help reset Anika’s strategic direction and unlock significant value for shareholders.

David Johnson

Managing Partner

Caligan Partners LP

[1] See Appendix 1 for a discussion on the viscosupplement market and the competitive positioning and value of Monovisc and Orthovisc.

[2] As disclosed on page 33 of Anika's proxy statement for its 2022 annual meeting of shareholders.

[3] S&P Capital IQ, as of August 15, 2022, the day which Caligan began acquiring shares of Anika

[4] ANIK’s medical device proxy peers defined as GKOS, ORGO, SRDX, VCEL, OFIX, AXGN, ATRC, AORT.

[5] Figures as of August 15, 2022.

[6] “510k Approved Devices are Lower Risk but also Less Differentiated.” – UBS, July 15, 2021

[7] “incremental investments to drive sustainable growth longer term continue to pressure the near-term outlook.” – Stephens, March 18, 2022

[8] S&P Capital IQ. 3Q2022 earnings transcript.

[9] Dr Cheryl Blanchard, 2021 Investor Day Transcript, S&P Capital IQ. Dr. Blanchard stated that the Company expects to “double our 2019 revenue in mid-teens revenue CAGR, driving to an adjusted gross margin that expands to greater than 70% and double-digit adjusted EBITDA growth run rate by 2024, which gets us to a greater than 20% adjusted EBITDA margin.”

[10] Barrington Research, March 9, 2022.

[11] S&P Capital IQ. Earnings transcripts 4Q2019, 1Q2020 withdrawing guidance altogether. 4Q2020, Company expected full year joint preservation revenue growth in “upper 20s to low 30s percent range”, in 3Q2021, guidance reduced to “upper teens”. In 4Q2021, guidance was for “mid-single digits to low teens” and in 3Q2022, guidance for JP was lowered to “low to mid -single digit.”

Source:

https://www.sec.gov/Archives/edgar/data/898437/000090266423001925/p23-0964dfan14a.htm